In recent months, the Panama Canal has experienced a significant reduction in shipping transit volumes, with plans to further decrease capacity to 50% by February 2024.

Simultaneously, the Red Sea has become a hotspot for disruptions caused by drones, rockets, and various other activities of the Houthi rebel group.

These seemingly unrelated events, thousands of kilometres apart, have the potential to converge into a perfect storm, both metaphorically and literally.

The pressing question is whether these disruptions will exacerbate the already spiralling inflation that central bankers are striving to control and the cost-of-living crisis that politicians are eager to rein in.

Ocean-going vessels play a vital role in the global supply chain, accounting for approximately 80% of all freight transportation. Between 1990 and 2021, the cargo transported by sea more than doubled, reaching nearly 11 billion tons.

In 2021, the Panama Canal generated approximately US$2 billion in net income, constituting around 3% of Panama's GDP. Today, ships are being rerouted via Cape Horn instead of waiting their turn or paying exorbitant prices to jump the queue for passage.

In June 2023, the Panamanian government declared an environmental emergency due to a severe drought, which might not have garnered much attention outside the Americas.

Meanwhile, the Houthi rebels, with possible external support, expanded their operations from targeting Israeli-owned or bound ships to disrupting all shipping passing through the Red Sea. This led to an effective blockade of the Suez Canal, compelling major shipping companies like Maersk, MSC, and HAPAG-LLOYD to reroute their vessels via the Cape of Good Hope.

Adding further complexity to the situation, on December 23rd, a drone launched by Iran struck a chemical tanker off the coast of India for reasons that remain unclear.

So, does this matter? The financial repercussions for governments, economies, and ultimately, individuals, remain uncertain.

In simple terms, if it takes longer for goods to reach customers, the prices on store shelves or at the fuel bowser, tend to rise. For those of us in Western countries, the immediate monetary impact may be negligible but the long-term repercussions could be substantial.

However, as oil and food, in particular, arrive at ports after spending more time at sea, shipping costs, calculated based on days at sea, will contribute to the inflationary pressures that central banks are actively combating.

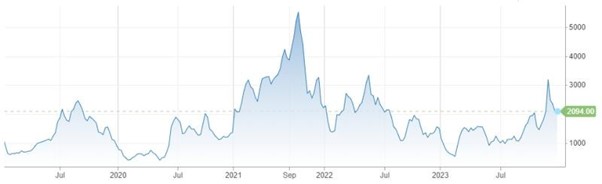

The Baltic Dry Index (BDI), reported daily by the Baltic Exchange in London, serves as a benchmark for the cost of transporting materials by sea. Given the lag between chartering a ship and its impact on consumer prices, the BDI provides valuable insight into demand and, in this case, inflation.

Can the BDI offer a glimpse into the future of inflation? To answer this question, let's reflect on the past. In early 2020, as countries initiated lockdowns and rejected incoming ships due to COVID-19, the BDI plummeted to $500. However, as the world adapted to the "new normal," pent-up demand propelled shipping costs to over $5,000, ten times the lows seen during the pandemic. In early 2022, Russia's invasion of Ukraine caused another surge in shipping prices, and later in 2022, the Ever Given incident blocked the Suez Canal for six days, leading to a spike in shipping costs.

What does the chart predict when it comes to the dual crises of the Panama Canal ‘Dry’ and the Suez Canal ‘Fireworks’. The chart suggests that the efforts of central banks to control inflation and government efforts to stabilise living costs have been undone, or at the very least, set back by several months.

This implies that interest rates will likely remain at current levels for a period longer than expected and certainly longer than politically palatable. In the long term, given the considerable time required to build ships, the cost of sea freight is expected to remain high for some time. While trucks, trains, and even air transport can mitigate some pressure, they are unlikely to noticeably reduce charter prices.

These challenges we face today - climate change and our struggle to coexist despite our differences - underscore the complex issues confronting humanity.

Perhaps, by addressing the latter, we may find a path to addressing the former.