Commercial Real Estate (CRE) has long been a mainstay of investment portfolios worldwide. Owning a superannuation account in Australia likely means exposure to CRE, even overseas, like in the United States (US). Recent "fire sales," particularly in the US, raise concerns: are stable long-term returns a thing of the past?

CRE's appeal lies in consistent passive income and underlying asset appreciation. Various classes exist, including Office, Retail, Industrial, and Hotels. This article focuses on Office Space.

Similar to private homeownership, most CRE relies on credit. Mortgage-Backed Securities (MBS) became infamous during the Global Financial Crisis (GFC). CRE has its own equivalent: Commercial Mortgage-Backed Securities (CMBS), though with much less notoriety. However, post-GFC Basel III regulations enhance investor safety through bank capital and liquidity rules.

Two key differences exist between MBS and CMBS. CMBS loans typically have shorter terms, forcing mortgagees to "roll over" loans, essentially reapplying and allowing lenders to adjust terms. In the residential market, this usually happens only during refinancing.

COVID-19 turned offices into virtual ghost towns. Bustling cities lost foot traffic, and with it, office workers' spending power.

COVID-19 had broader impacts. Central banks slashed interest rates to historic lows to revive economies. This benefited CRE securities with historically favourable terms, enabling investments not previously possible.

Fast forward to 2023. Many office workers resist returning, preferring the conveniences of working from home. Companies embrace work-from-home options, reducing their office footprints and increasing CBD vacancy rates. US CBD office spaces reached an all-time high vacancy rate of 19.6% in Q4 2023.

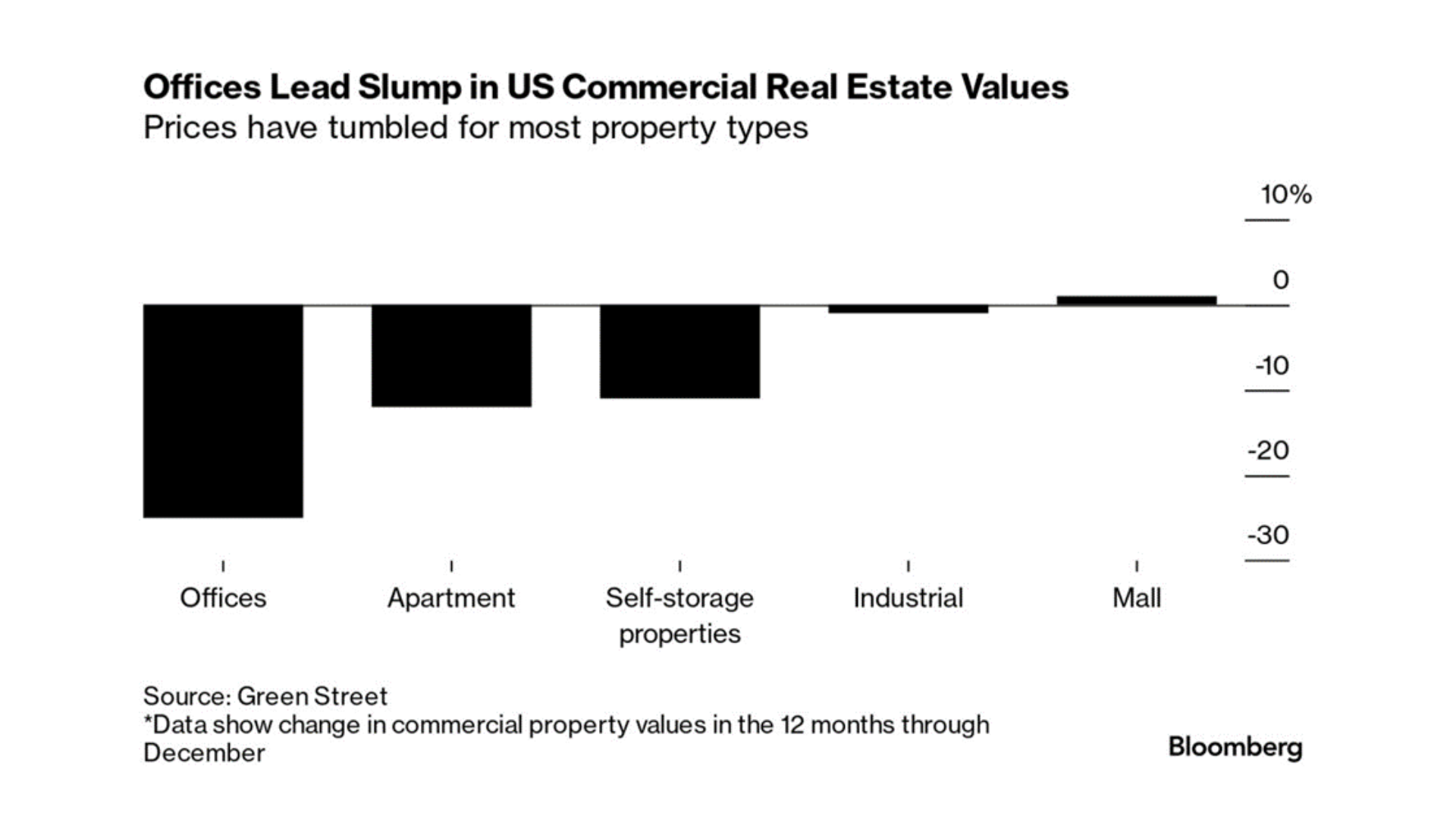

Office vacancies directly impact investor income and investment value. A recent Bloomberg chart illustrates the dramatic impact over the past year.

As building owners seek loan rollovers (an estimated $1.2 trillion in the US alone over the next two years), they face two challenges: increased vacancy rates and significantly higher interest rates. This reduces value and increases lender risk.

Lenders may decline further loans, forcing borrowers to find alternative lenders or engage in distressed sales. More distressed sales would further decrease CRE Office investment value, creating a vicious cycle.

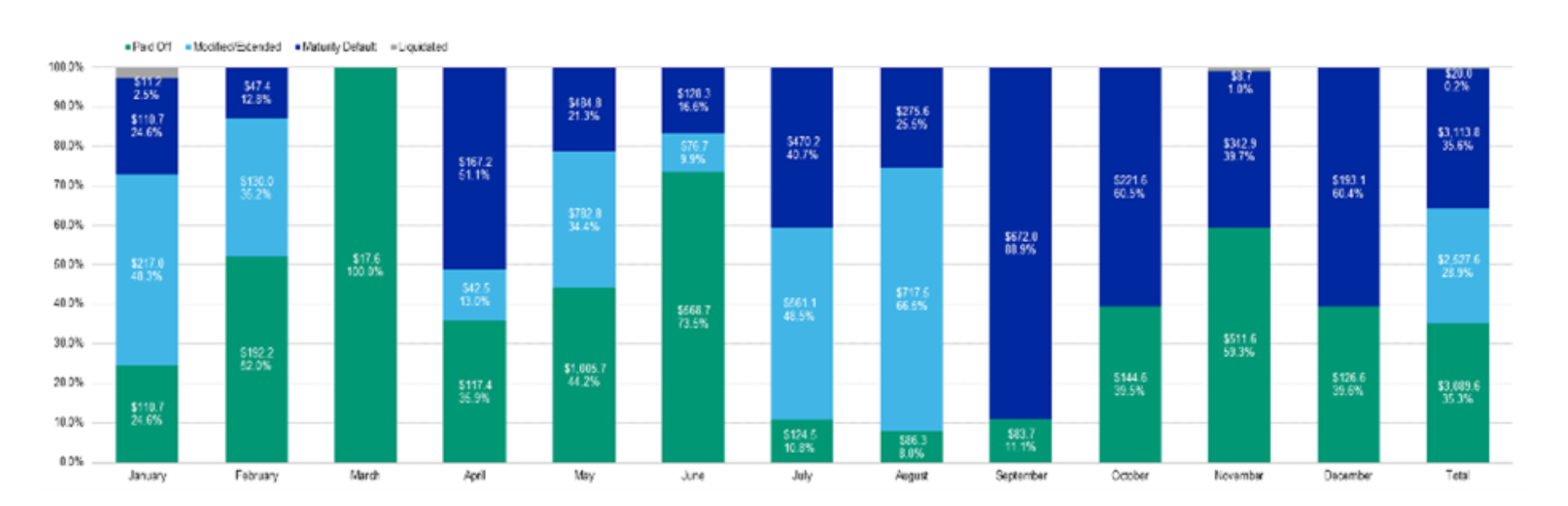

Moody's latest CRE Office Loan Maturities Monitor report paints a concerning picture. It says that "80% have current performance characteristics that would make them very difficult to refinance." Moody's also describes the pay-off rate as the worst since 2009, just after the GFC.

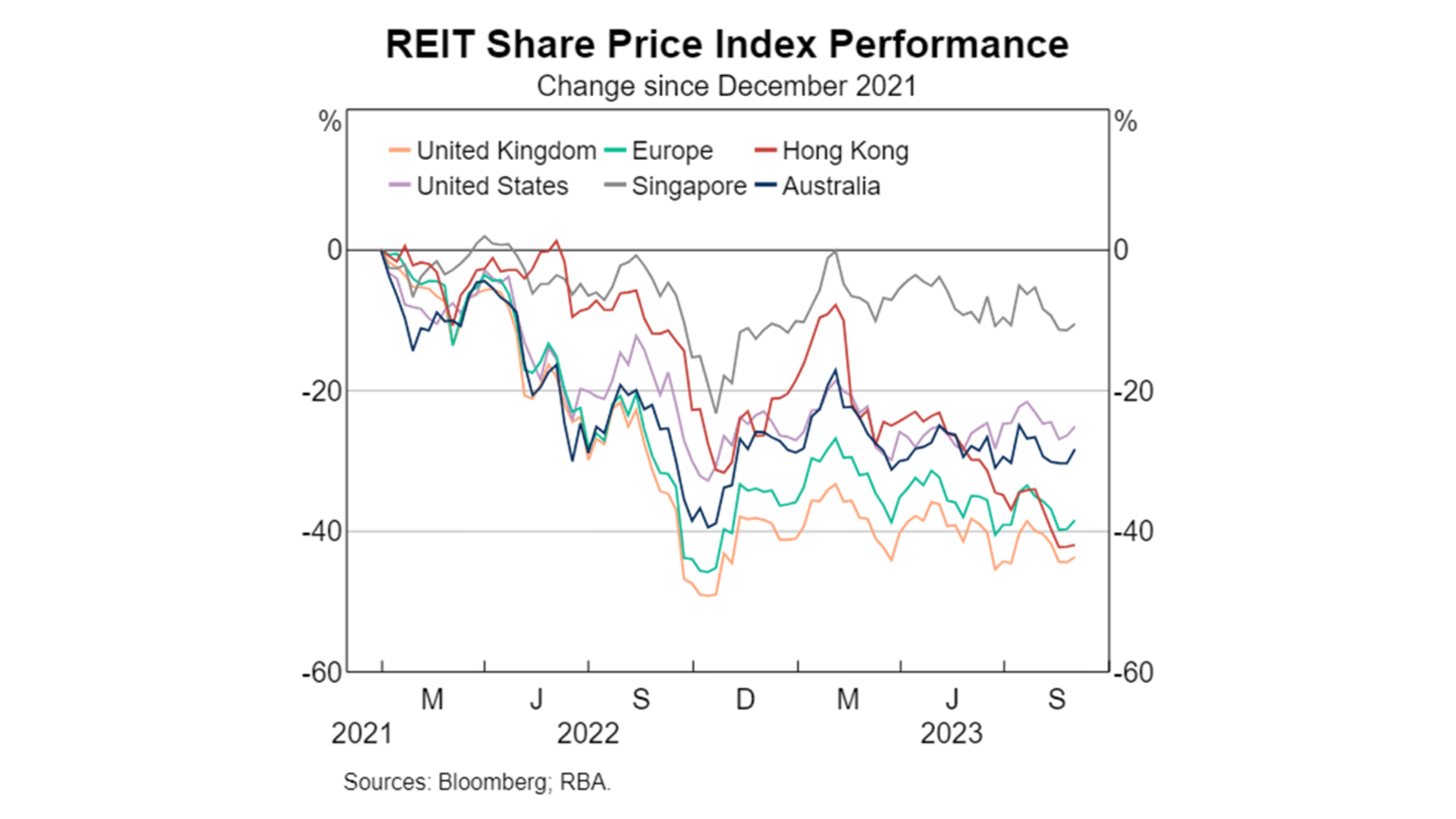

The Reserve Bank of Australia echoes those concerns, acknowledging pressure on CRE globally and its impact on Real Estate Investment Trusts (REITs).

Super funds like AusSuper are reconsidering their CRE exposure and even writing off some assets.

While challenges exist, opportunities remain within CRE. Warehouses, data centres, and other logistics and service buildings are poised to benefit from the ongoing shift towards e-commerce and on-demand delivery.

The CRE market faces an iceberg, but even amidst challenges, opportunities lie ahead for those who adapt.