Recap from Part 1

Usury, being any nominal value differential in a current-for-deferred cashflow exchange (i.e., any amount beyond the nominal ‘principal’ amount) is prohibited in Shariah. Interest, as conventionally understood and practised in Australia, is deemed by consensus of recognised Shariah scholars to be usurious, and therefore prohibited.

asset financing (such as residential real property finance) typically requires an asset exchange, in parallel with the current-for-deferred cashflow exchange, as an intrinsic part of the transaction so any monetary excess (i.e., the cost of finance) is not deemed usurious.

Issues in commercialising

From a practitioner’s viewpoint, developing a dual (i.e., local regulation and Shariah certified) compliant consumer residential finance product has been (and continues to be) singularly driven by the question “can it be funded?”.

Given the commoditised nature of consumer residential property finance in a developed jurisdiction such as Australia, it should come as no surprise that price leadership is also the key success criterion for originating Shariah-certified alternatives. Well and truly gone are the days when such a product could be priced at 50BPS+ over a comparative conventional offering on a sustainable basis across multiple market cycles. Recent empirical evidence would suggest that when the price differential approaches 10BPS, demand steeply drops off with lower-priced conventional substitutes being taken up.

Back to the pivotal issue of “can it be funded?”

With the exception of Shariah-certified registered mortgage funds such as the MCCA Income Fund TM, there are a limited number of third-party funders (mainly non-ADIs) who currently provide facilities into this segment as a minor part of their much larger conventional business footprint.

Understandably, continuing to service this niche segment is purely a present value commercial proposition for these funders. As such, the extent of product differentiation tolerated (i.e., towards achieving a Shariah certification) is always subservient to ensuring that any such differentiated assets when originated could seamlessly sit within these funders warehousing facilities together with conventional mortgage finance assets.

It is not in these funders interest to take on a differentiated product funding line as a minor business stream that would require it to be carved separately from its own existing funding framework. Within an Australian context, such an arrangement would obviously attract a wholesale pricing premium that would render the resultant end consumer product unsellable in comparison to conventional substitutes (APS/G 112 eligibility criteria for residential mortgages looms large given that ADIs mostly fund the senior warehouse tranches of these non-ADI aggregators).

The prevalence of the funder’s legal assurers (who essentially ensure that the differentiated product can fit seamlessly into existing funding frameworks) over the Shariah scholar (seeking to reflect the Shariah requirements including underlying asset transfer) has meant that more substantive concessions to Shariah precepts are required.

Notwithstanding the reputation of the certifying Shariah scholar, critics of Islamic finance as its currently practised locally point to a similarity in substance – particularly between Shariah-certified residential financing products and their conventional substitutes – as evidence of inadequate Shariah compliance by practitioners.

Chief amongst these objections is the basis on which these Shariah-certified products are priced.

Just as APS/G 112 drives the legal and risk profile of a Shariah-certified residential mortgage offering, the predominant benchmark compelling repricing decisions for these products is also unsurprisingly referenced back to the ADI sector.

Whilst peak global Islamic finance Shariah standard setting bodies such as the Accounting and Auditing Organisation for Islamic Finance Institutions (AAOIFI) do not explicitly prohibit the implicit use of interest-based benchmarks (such as LIBOR and by extension, BBSW), suffice to say an alternative to such would be ideal.

The Catch 22 for local Islamic finance practitioners – particularly in the residential finance space – is this trade-off between competitive product funding and sufficient product differentiation to effectively market and originate. The current monetary policy tightening cycle has brought this issue to the forefront.

Looking forward

From a practitioner’s perspective, what would be ideal?

From the lens of improved consumer finance product differentiation to augment origination (and segment growth), legislative pari-passu treatment would be amongst the top of any wish list. Many have previously trodden this path over the past 20+ years with the singular notable achievement being MCCA’s facilitating changes to the Victorian Duties Act back in October 2004. Not a great record of success.

In the absence of effective legislative recognition in the near term, would the introduction of a form of credit intermediation different to that currently servicing the segment be a game changer, particularly in terms of segment growth?

Whilst acknowledging the disruptive potential of new fintech-based offerings into the segment, the lack of scale of the segment demographic (not much more than 325,000 households) would suggest that any intermediary specialising in this demographic would similarly be limited by scale, with flow-on implications for its fund-raising capacity and pricing.

This limitation of scale, when coupled with; the negligible current premium for Shariah-certified product differentiation, the perception of catering to a singular faith demographic and the absence of regulatory recognition covering any substantive product differentiation, has to date also disincentivised those entities that do possess scale from directly committing their core brands to Shariah certified consumer finance offerings where compliance requirements are less forgiving.

A gloomy outlook?

Not in the least!

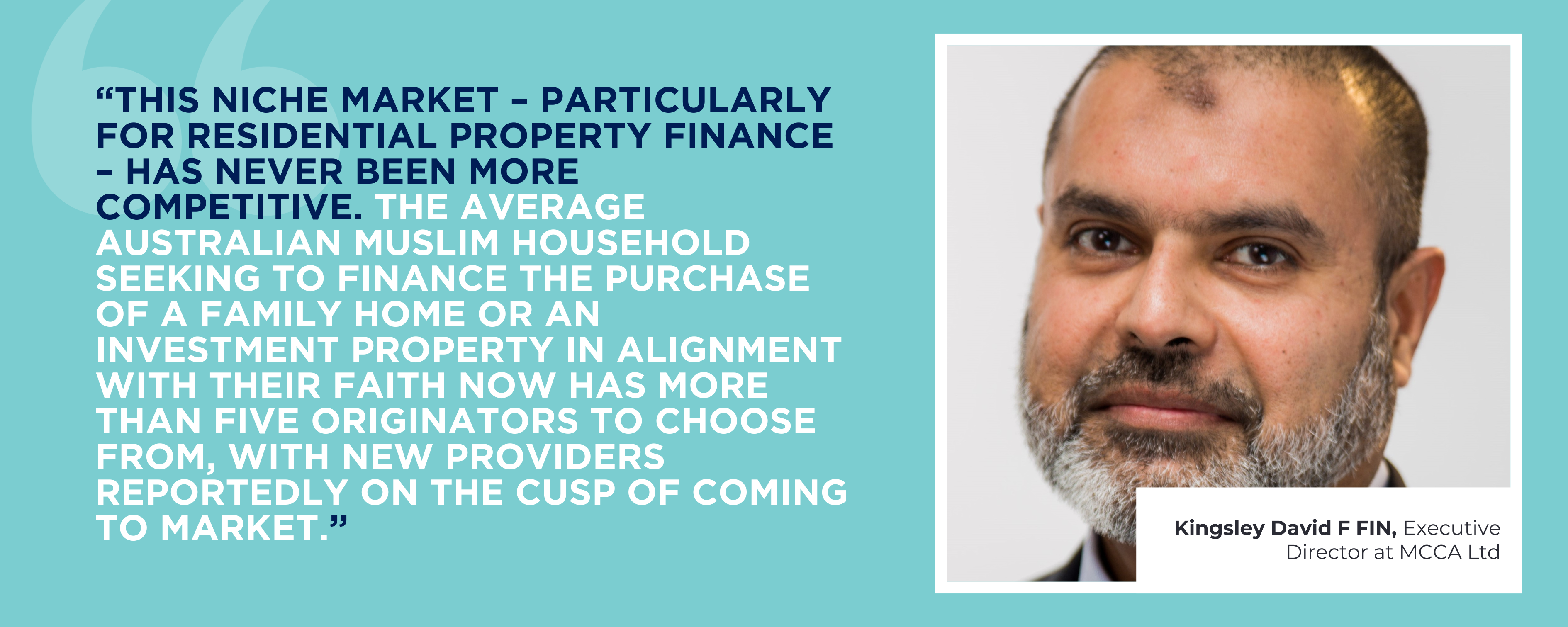

This niche market – particularly for residential property finance – has never been more competitive. The average Australian Muslim household seeking to finance the purchase of a family home or an investment property in alignment with their faith now has more than 5 originators to choose from, with new providers reportedly on the cusp of coming to market.

A win for the end consumer in terms of price and product choice can only be viewed as a success story.

Want to find out more about Islamic Finance? FINSIA has partnered with the Chartered Institute for Securities & Investments to offer a range of courses as part of its Professional Refresher Package that includes the topic. Find out more here.